Call Florida Public Adjusting and have a full inspection and evaluation of all the damages at no cost. Our public adjusters are fluent in residential and commercial insurance policy language, and we understand what you are truly covered for by your insurance company.

Our public adjusters deal directly with your insurance company, relieving you of their persistent demands. Your insurance company will send an adjuster representing them, assure you have an adjuster representing you.

Get paid the full amount you deserve, with Florida Public Adjusting you receive the highest compensation for your insurance claim as quickly as possible. Allowing you to focus on what matters most.

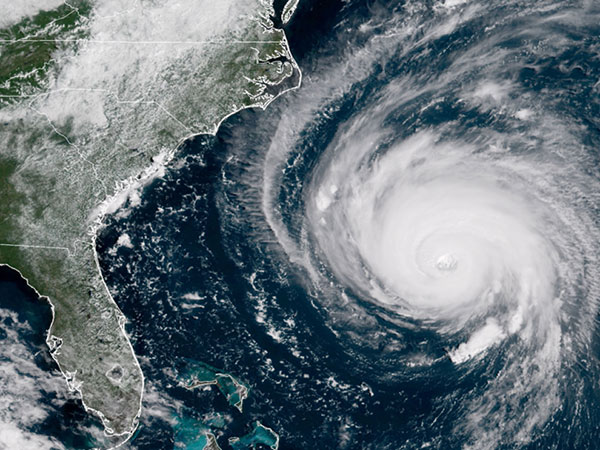

Property owners in Florida generally love the idyllic climate of the Sunshine State, but with it comes the potential for wild weather and destructive tropical

Tropical windstorms, thunderstorms, tornadoes, hurricane and floods, in Florida you’re bound to run into mother nature’s fury. It’s a well-known fact that Florida’s tropical climate

It is important to contact us at the as soon as possible in order to secure the highest settlement for your claim. Early communication helps

Our team of Public adjusters serve all major cities in Florida including: Miami, Miami Beach, Aventura, Weston, Fort Lauderdale, Boca Raton, Palm Beach, Tampa Bay, Naples, Panama City.

Florida Public Adjusting is the leading Public Adjuster in Miami. Looking for a Miami Public Adjuster? Call Florida Public Adjusting.

Our Miami Public Adjusters are to help South Florida residents with all type of insurance claims including, denied & underpaid insurance claims.

Looking for a Public Adjuster in Miami, Call today for a FREE consultation and home inspection with one of our Public Adjusters in Miami.