Public Adjuster in Palm Beach – How to hire?

If you’re one of those who find filing insurance claims daunting in the aftermath of disasters, or you feel that you’re inexperienced and not up to the task of accurately estimating your property losses, you might want to avail of the services of a public adjuster this side of West Palm Beach.

A public adjuster can help you as an individual policyholder by assessing the damage to your property and estimating how much you’d need to repair or rebuild insured property. They can then assist you in the tedious process of filing claims from your insurance company. While it depends entirely on the policyholder if they need help — based on their needs, abilities and circumstances, it is advisable to seek the advice of one for high value claims.

This especially holds true if it is worth the cost of hiring one, which is based on a certain percentage (subject to state limitations) of the amount claimed from the insurance company. For example, a public adjuster would usually charge 5% to 20% of the claim, and in Florida, the ceiling is set at 15%. In cases of declared state of emergencies, claims are capped at 10%.

How to Hire Good Public Adjuster in West Palm Beach?

Once you’ve decided to use a public adjuster, the next question is how to find one? A professional public adjuster in Palm Beach is not hard to find. But you shouldn’t take it lightly and just hire the first Public Adjuster around Jupiter that you find. Check out a few, compare and choose the best one suitable for your needs. Here are some things to remember when scouting around Florida for the one you think can help you the most with your insurance claim:

-

Permit and License to Practice. As with any other professional practice, a reputable public adjuster in Palm Beach should have the necessary license to practice in Florida. It is not only illegal to practice without a license, but they are proof of their knowledge and experience.

-

Accreditation and Training. They must also be bonded and are updated with the latest changes by taking up continuing education classes to keep their license. You can also check membership in local trade associations in your state or other known institutions like the National Association of Public Insurance Adjusters (NAPIA). They can also assist in case of dispute with your public adjuster.

-

Length and Scope of Experience. There are a lot of public adjusters out there who just recently got their license, thus they might not have enough experience for your particular situation. Always ask and check how long they have been in the business. Remember, there different types of claims and scenarios, so ask them if they have handled similar cases like yours and if they have worked with your insurance company before. Verify whatever information you have learned.

-

Client Referrals. While it is best to get recommendations from close relations and acquaintances, you can also ask the public adjuster for at least 3 referrals. Check and reach out to said previous clients and ask them about their personal experiences working with said local public adjuster in Jupiter, Florida.

-

Budget and Price Range. While you may be working on a tight budget and want to maximize your claims, bear in mind that cheap is not necessarily the best option. As they say, you have to pay good money if you want good service. Keep in mind how much you are willing to let go from your insurance claim in order to get the most favorable service you need. More experienced adjusters usually charge higher fees, typically 15% or more. Beware of those who charge significantly less than 10%, they might be inexperienced at best, unscrupulous at worst.

-

Service Coverage and Level of Involvement. These are just some of the things you need to clarify with them, to set and manage your own expectations. A reputable public adjuster in West Palm Beach may only be handling a few clients at a time to focus on each case. Additionally, if you prefer to work with only one adjuster, set this straight with the company. There are times a public adjustment firm sends more than 1 adjuster depending on the expertise needed. Another thing you’d want to consider and straighten out with your public adjuster is your involvement in the process. Some policyholders still want some involvement and to be able to talk with insurers, while others don’t want to be bothered with the details. Likewise, you should feel comfortable communicating with both your insurance agent and public adjuster as you’ll be working closely with them for a period of time.

In times of disasters or unfortunate events, you’d need as much expert help as you can get your hands on. Though you might be inclined to, don’t rush the process of choosing your public adjuster and exercise due diligence by doing your homework. Don’t let anyone sweet talk you into signing a deal before you are ready to. An informed decision may make or break the whole experience called insurance claims.

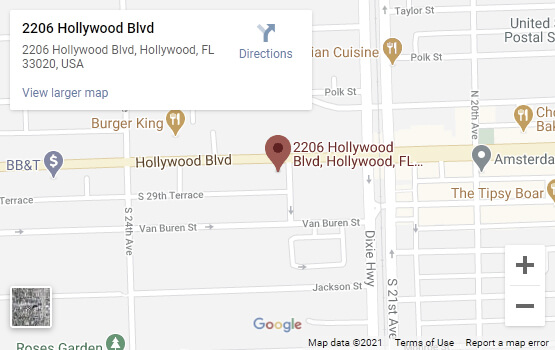

Call Florida Public Adjusting today for a free consultation