Will Hiring A Public Adjuster Get More Settlement Money For Your Insurance Claim?

A public adjuster is a person who provides claims handling and negotiation services to insurance holders. Aside from lawyer and insurance agent, public adjuster also act as legal representatives for consumers during the claims process. They are responsible for protecting the rights of an insured or policyholder. Their knowledge and expertise can help property owners recover the best possible insurance coverage for their claims. Public adjusters are usually more competent than the claims representatives and/or insurance carriers’ employees. It is because, in most cases, they are more likely to get a better settlement than the professionals who handle the claims.

What public adjusters do?

Getting a claim for property damage can be a bit challenging. It can also be time-consuming and stressful. Fortunately, there are various resources out there that can help. Public Adjusters are professionals who work for you and your insurance company. They handle all of the details of your claim, from determining the exact amount of coverage to negotiating the settlement.

Being reliant on the advice of insurance companies and their adjusters is almost guaranteed to result in a less-than-fair settlement. Having a public adjuster to rely on can help you get the settlement that is right for you. It is also a vital step to having a fair claim.

Advantages of Hiring An Experienced And Licensed Public Adjuster

Here are advantages if hiring experienced and licensed public adjusters:

Saves you a lot of time

- They are experts in insurance policies and know the various practices of insurance companies. It ensures they will get the most money possible for your claim.

- They take the time to understand your business and personal needs thoroughly. They will assist you to get the most out of your insurance coverage.

Relieve your stress

- They will help you to be updated with the latest developments in the claim process and give you the advice and support that you may need along the process.

Will Give you a proper settlement

- Public adjusters are experienced and skilled insurance professionals who will thoroughly document and defend your claim. They will also challenge the insurance company’s offer if necessary.

Getting hit by a disaster can be a stressful experience, and it can take a toll on your time and resources. Talk to one experienced Public Adjusters to get the most out of your insurance claim.

Things To Consider When Hiring Public Adjusters

Public adjusters help people settle their insurance claims. They help people avoid costly mistakes. Your insurance company will typically provide an adjuster for no charge. However, if a public adjuster works for you, they may charge a fee for their services.

That’s the reason why if you are thinking about hiring a Public Adjuster, here is what you have to consider:

Check the qualifications and references of the public adjuster you will choose

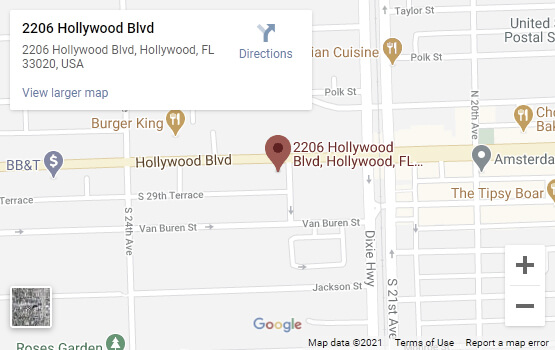

Before hiring a public adjuster, ask for references and ask for recommendations from family members and associates. Also, make sure that the person is licensed in the state where the loss occurred.

Avoid choosing a public adjuster that will give you more pressure

Make sure to read the contract or agreement carefully to avoid getting pressured by a public adjuster. If you are dealing with a public adjuster, make sure you understand all the terms of your agreement before signing.

Be mindful of the facts before and after a major disaster

Before a major disaster, ask about the charges of public adjusters. Be wary of them if they go door-to-door. You should also know the costs that public adjusters may charge after a disaster.

Will Hiring a Public Adjuster Get More Money For Your Insurance Claim?

Even after taking into account the public adjuster’s fee, homeowners who hire them usually get a higher settlement. It can be hard to know what it is like to lose your home, and it is likely to cause you tremendous stress and grief.

It is crucial that you do not get carried away with the things that your insurance company promises. Getting into an argument with your insurance company can be a bit of a hassle, primarily if it has been handled improperly.

Wrapping Up

Many individuals and professionals who are unable to handle claims due to physical or mental impairment seek the help of a public adjuster. This service helps minimize the stress of the claims process and allows them to focus on their goals. As public adjusters, they work with insurance companies to determine the most appropriate amount for the loss. They then prepare detailed reports and estimates based on the evidence they gather from various fields such as forensic science, construction, and engineering.

Once an impasse has occurred between the claimants and the insurance companies/carriers acting as licensed adjusters, the use of adjusting methods becomes futile, which would result in the insurance companies/carriers getting an unjust advantage through the use of public adjusting.